One of the most discussed topics in magazines such as the Practical Punting Monthly and on the numerous racing forums on the Internet is on staking plans.

Do they work or don’t they?

In the main, those with a mathematical bent will tell you they don’t, stating that in the long run the expectation of returns, profit or loss, will be exactly that which would otherwise be achieved by betting level stakes.

Some mathematicians will concede that staking plans, such as Kelly’s Criterion, will work, that they are capable of enhancing returns where there is a level stakes profit.

In this article I will discuss two staking plans, the pitfalls and benefits, presenting one that will enhance returns where the selections show a level stakes profit.

In particular, the Steady Drip, while ideal for those betting on short-priced horse racing selections, could just as well be applied to sporting events involving two teams or players.

But staking plan or no staking plan, the fact remains that most punters lack the discipline to adopt and adhere to a systematic approach with their betting. No, I do not mean the adoption of a system per se, but a systematic approach to money management, which is something different.

So what is money management?

In his classic book on betting, Commonsense Betting, US author and professional punter Dick Mitchell stated the following:

“Money management is a systematic method of choosing bet size and betting opportunities in such a manner as to maximise our rate of growth of wealth and at the same time minimise our chances of going broke. It’s a major weakness of most horse race investors, stock-market investors, real estate investors, sport bettors, gamblers, and investors of all persuasions.”

In Mitchell’s opinion the best money manager he knows is another US professional punter Barry Meadow, the successful publisher of Money Secrets at the Racetrack, excerpts of which have been published in Practical Punting Monthly from time-to-time.

Meadow offers four pieces of advice:

- Keep records of all bets and expenses;

- Do not overbet in relation to your bankroll;

- Bet more when the value is greater; and

- Bet within your emotional threshold.

My guess would be the majority of punters would not abide by any one of those four pieces of advice, let alone all four, and that is just as likely to be as true for those who consider themselves good form analysts/handicappers as it is true of all punters.

Goodhandicapping skills and good money management skills can be mutually exclusive to one another.

The bane of many staking plans is the escalation of bet sizes in such a way that they test the emotional threshold, the comfort zone factor, of users that they abandon such an approach, accepting any accumulated losses as “part of the game”.

Of course, the reason many staking plans (and their users) come under such pressure is another bane – long losing runs, which can be demoralising.

I’ve often been asked questions along the lines of, “My strike rate is 35 per cent, what kind of losing run can be expected?”

The answer of course depends on the overall number of selections: in the case of selections with a 35 per cent strike rate, then a losing run of nine could be expected if there were 100 selections but the expected losing run would grow to 14 if there were 1,000 selections.

Of course, these are the “expected” longest losing runs, but they could be higher and the fact that they sometimes are is what catches many punters out.

Both of the staking plans presented in this article are recommended for use only where there is a level stakes profit.

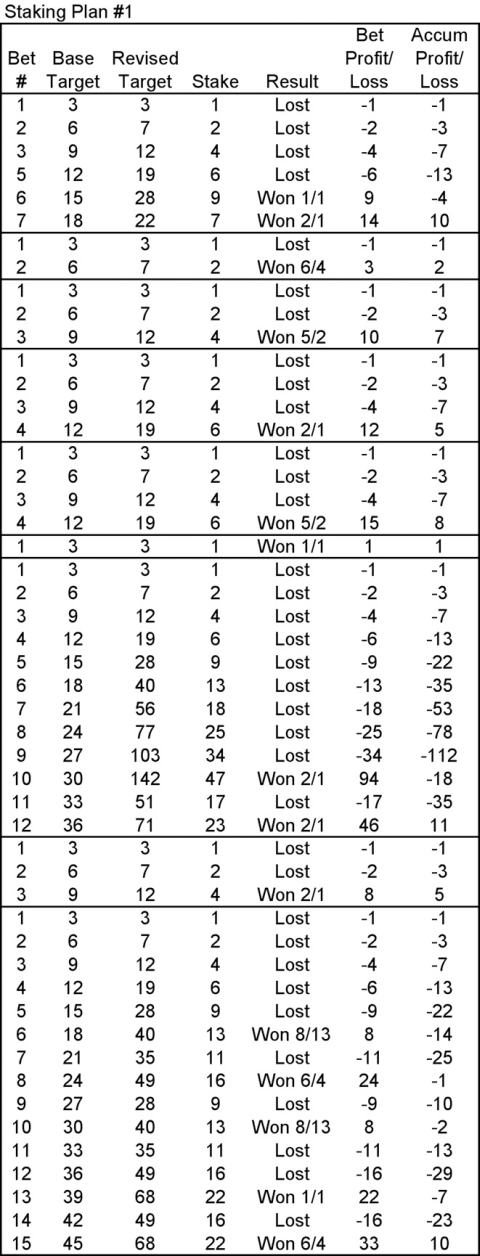

Legend:

Column 1: Bet # – self-explanatory.

Column 2: Base Target, which is set to 3 per bet in this example. Add 3 for each bet in a sequence until a profit is made and the sequence is closed.

Column 3: Revised Target, which is the sum of columns 2 (Base Target) and 7 (Accumulated Profit/Loss). Column 7 is always treated as a positive value when adding to column 2.

Column 4: Stake, which is derived by dividing column 3 by three (Base Bet), always rounding down to the next whole dollar.

Column 5: Result – self-explanatory.

Column 6: The amount won or lost on this bet.

Column 7: Accumulated profit or loss for the sequence.

Once a sequence is in profit it is closed and a new one commences.

Staking Plan #1 presents a particularly bad sequence of 50 favourites, producing only 15 winners and level stakes loss of over 12 units, a Loss On Turnover (LOT) of 24.5 per cent, while the staking plan returns a 59 units profit which equates to a Profit On Turnover (POT) of 13.3 per cent, an amazing turn-around.

This sequence is a sub-set of a larger set of selections which overall has a strike rate of 35 per cent at an average price of approximately 2/1 ($3) that produces a POT of 5 per cent.

It highlights what can and does happen and the reason this particular sequence was used was not so much to display the merits of the staking plan but more to display how high the stakes can escalate when the going gets tough.

While staking plans of this nature can get the job done, there are some issues that are personally unappealing, such as the first three bets in a losing sequence adopting a too aggressive doubling-up approach and that any extended losing run could put pressure on the user.

With that in mind, at best this staking plan should only be considered where the strike rate is high and the selections are first or second favourites in races with only a few obvious chances.

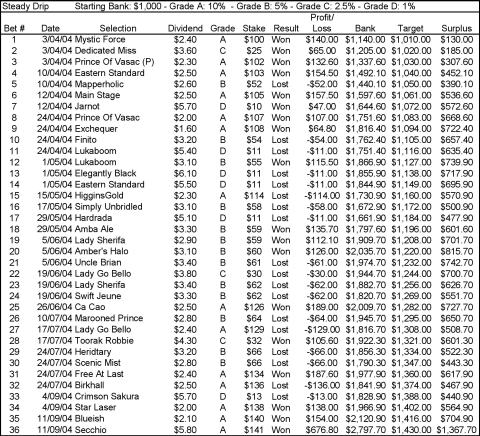

The second of the staking plans is named the Steady Drip, which is an excellent method for enhancing returns on the right type of selections where a level stakes profit exists.

This staking plan has been around for years in various forms and is named the Steady Drip for the simple reason that it refers to the old saying “A steady drip will always fill the bucket”, as this is what it will do in a simple and a less aggressive manner than many other staking plans. The aim of the Steady Drip is to win 1 per cent of our target by risking no more than 10 per cent of the target per bet.

This method has some strong factors to recommend it as it takes into account elements of the Kelly Criterion without the aggressiveness, while also taking into account the user’s confidence levels.

While simple to operate, it is a staking plan which can compound and maximise winnings whilst ensuring exposure is never more than 10 per cent of the targeted amount.

To demonstrate the Steady Drip staking plan, I’ve used a slice of 36 selections of fellow Practical Punting Monthly contributor Roman Koz’s Perth selections.

When using the Steady Drip, the stake is determined by two factors: a) the grade of the selection and b) the target.

For the purpose of this example, the bets have been graded according to the final SuperTab dividend, where “A” grade selections are those at $2.50 or less; “B” grade selections are those between $2.60 and $3.50; “C” grade selections are those between $3.60 and $5; with “D” grade selections being those at $5.10 or higher.

The initial target is always 1 per cent of the starting bank and from then on 1 per cent of the previous target.

The amount shown in the surplus column is the differential (plus or minus) between the actual bank and the target.

Should there be a negative surplus then the stake is based on the actual bank and not the target until such time as a positive surplus is restored.

In this example, Roman Koz’s selections have done particularly well by showing a profit of 18 units at level stakes profit, returning a POT of 50.3 per cent.

The Steady Drip staking plan enhances the profit to what amounts to an equivalent of 24.75 units profit, returning a POT 68.7 per cent.

However, as mentioned, the Steady Drip staking plan will only work where there is a positive expectation, i.e. a level stakes profit, and is best used on high strike rate selections.

Importantly, this plan will work best for those that have the ability to correctly grade their selections accurately, as any failure to do so will lead to some stakes being too high or conversely some stakes being too low and an unsatisfactory outcome.

By EJ Minnis

PRACTICAL PUNTING - NOVEMBER 2004