Although most punters are doomed to lose, it's an interesting facet of betting life in the world of horse-racing that the actual betting markets, produced by weight of money, are very efficient. It's basically the "takeout" (tote or bookmaker) that wrecks the normal punter's hope of ending up a long-term winner.

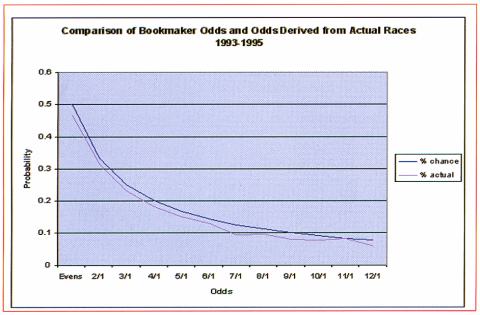

A study of all horses in UK flat races (seasons 1993-95) was used recently to point up the efficiency of the market traits. The odds of each horse at SP (starting price) were compared with the actual outcome of the races.

The author noted: "The market, that is the punters, were remarkably good at predicting the actual chance for a horse to win the race."

Most experts who study racing via straight statistics, and maths, firmly believe that anyone who has what they call a "naive" approach to betting is never going to make any money.

One of these experts says: "Instead, the punters must use a more sophisticated approach to selecting a good bet. We know that a horse going off at 2/1 has an approximately 33 per cent chance of winning.

"We can assume that the bettor has transaction costs, such as travelling costs (if betting at the track), telephone charges for betting online, and, of course, the fact that the bookmaker has an over-round book, thus eating further into the bettor's profits.

"Therefore, a bettor must look for what is known as a value-for-money bet. Essentially the bettor is looking for a situation where the market has mispriced a horse, such that the horse's chance of winning is greater than the market believes it to be, and that the edge is greater than the transaction cost.

"For example: You may decide that a horse has a 4/1 chance of winning the race but has been overpriced at 5/1.

The mathematical expectation for this horse is 20 per cent and so, over time, betting on this arbitrage situation will yield a profit of 20 per cent."

The expert then identified some areas where he believes it is possible to beat the bookies in the betting market:

- Find a filter rule that filters out, for example, all 2/1 horses that stand no chance of winning. Even though the market believes the horse has a 33 per cent chance of winning, you know it has close to no chance of winning.

So, finding enough of these cases will allow you to bet on all remaining 2/1 horses and make a profit. - Combination bets: Optimally backing two or more horses in a race so that there is a positive expectation on either bet, no matter which horse wins.

- Discovery of mispriced horses; betting on horses whose chance of winning is greater than their odds suggest.

The points made by this person are nothing blindingly new, but they do point up quite forcefully what a punter really should examine if he or she is to get serious about making a profit.

For example, can the punter make a profit from the tipsters in newspapers and formguides? In this respect, a recent study had this to say:

"Horse-racing is notoriously full of insiders, be they owners, trainers, jockeys or stable lads. Like the securities markets, data on the returns these insiders earn goes largely undocumented.

"Tests have therefore focused on those who publish their tips. Snyder (1978) tested the returns from the tipsters' predictions in the Daily Racing Form (USA) and four daily newspapers. His findings show that not one of the tipsters earned a positive return after the bookies' take is subtracted, from which Snyder deduces that betting markets are strong form efficient.

"This analysis raises a number of difficulties. Firstly, newspaper predictions are made up to 30 hours before the off, so new information is not fully accounted for. Secondly, newspaper tipsters are employed to tip a horse in each race. Professional punters, on the other hand, will often sit a whole race meeting out without placing a single bet.

"A third deficiency in Snyder's methodology is the assumption that newspaper tipsters are examples of insiders on betting markets. In effect many are employed on a part-time basis, and have access only to information that anyone in the general public can obtain. Hence, Snyder's strong form test actually tests whether public information only, and not inside information, is incorporated into betting prices. Hence his strong form test should he relegated to a test of the semi-strong form."

My own investigation of horseracing betting over many years has led me on myriad paths, some short-lived, others long-term paths that provided me with profits, sometimes large, mostly small. But out of it all I now think the ONE magic key for a punter is this: BET ONLY ON SMALL FIELDS.

We know the betting market is efficient. It is at its best when the fields are small. These smaller fields make it EASIER for you to win. And you are very much more likely to obtain a value price.

In his celebrated book, Commonsense Punting, Roger Dedman summed one aspect of this up very neatly. Here's what he said: "The bookmaker who works to a balanced book has a profit margin which you can calculate by working through the prices he's offering. With a little practice you can do this quite quickly.

"The main advantage to the punter in calculating a profit margin is as an indication of likely market moves. This is a point appreciated by very few punters.

"If the margin is excessive, as is usually the case when opening quotes are put up at the start of betting, it indicates that prices will lengthen to bring the margin back to a more reasonable level.

"If, on the other hand, a bookmaker is operating on a very tight margin, he cannot afford to lengthen his prices any further, and there is less hope of obtaining a better price. You may as well back your selection now, as it is more likely to firm than to drift.

"What is a reasonable margin? This varies mainly with the size of the field. In a small field of, say, eight runners, most boards will be showing a holding of about 115; that is, if all runners were backed for a payout of $100, the bookmaker would have received $115 to cover his payout and his profit.

"In large fields, the holding may be 130 or even more. In the first six months of the 1977-78 Melbourne season, the average holding, based on SPs, was 121.8 but in races with fewer than 10 runners it was 115.5, and in races with 20 or more runners it was 128.9.

"It clearly follows that small fields are better betting propositions."

I think this conclusion is sound so far as PRICE is concerned. Wouldn't you feel better off backing a 2/1 favourite in a field of eight rather than a 2/1 favourite in a field of 18? I know I would.

If you back the favourites in all races of nine or fewer runners, it's my estimation you would probably break even or just lose very slightly over a year. Backing the favourites in fields of 10 to 13 would probably see you lose around 5 to 6 per cent, and probably a little more in fields of more than 13.

Not that I am suggesting you willy-nilly back the favourites. My approach is to pick out the small fields (no more than 10 runners), do the form, find the value runners and bet them. Any field with more than 10 runners, forget it.

By Alan Jacobs

PRACTICAL PUNTING - NOVEMBER 2002