The ode that accompanies this article may be sung to Beethoven's Choral Symphony or the lesser - known Elegy in F Minor by Poulenc, Though a requiem would be more appropriate, a requiem to the enjoyment and entertainment which heralded the introduction of the TAB.

Remember the early 1960s? The governments of the day introduced offcourse betting against concerted opposition from clerics and wowsers on one hand, and bookmakers on the other. The governments won the day. They argued that the TAB would give all punters the chance to enjoy their pastime legally. Those were the days when the statutory deductions from the tote pools were just 12.5 per cent.

The governments, now secure in their monopoly, gradually increased the deductions from the tote pools. In N.S.W., the Lewis Government went to 13 per cent; in 1977 the Wran Government took it to 14 per cent, when the late Ken Booth said, 'We need their money'. Fractional deductions through Sports Minister Mike Cleary were added in January,1986. The Liberal Party, then in Opposition, mentioned usurping this tax in their election policy!

The remainder of this article is addressed to the quantitive aspect of "enjoyment and participation" as exploited by governmental regulations, greed and misinformation. Ask about statutory deductions from tote pools and the reply is 14 per cent from win, place and quinella pools, 16 per cent from doubles pools and 17 per cent from trifecta pools. Deductions from Superfecta pools are not given but are greater, as will be shown.

According to Bert Lillye (Sydney Morning Herald, November, 1986) the deductions from win and place pools average 15.7 per cent, as calculated from the expected increase of monies into Consolidated Revenue from the fractional deductions. A closer inspection of actual dividends declared presents a considerable bias against place dividends, and also greyhound racing and harness racing, where the fields are smaller and, therefore, the average divvies are also smaller.

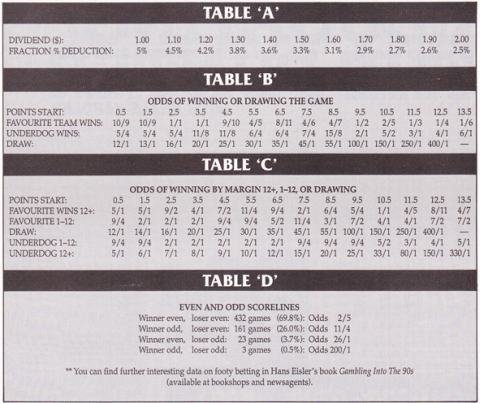

The smaller the dividend the greater the percentage deduction due to fractional takes. For example: A dividend of $1.20 (for $l) could notionally have been declared at between $1.20 and $1.29.

The average fractional deduction is 5 cents in $1.20, or about 4.2 per cent. Thus, the total deduction here is 18.2 per cent, not 14 per cent, as the public is led to believe.

Table A shows the increased percentage deductions to be added to the 14 per cent deductions already taken.

A $5 dividend encounters an average fractional deduction of a further 1 per cent, or 2 per cent should the notional dividend have been $5.09. The following figures show the disparate fortunes of punters who bet with the tote. The average deductions (%), after fractional deductions on thoroughbred, harness and dog pools:

| | Win | Place | Quin. |

|---|

| HORSES | 14.62 | 15.68 | 14.21 |

| HARNESS | 15.70 | 17.45 | 14.54 |

| DOGS | 15.53 | 18.05 | 14.82 |

As for superfecta pools: If the pool should jackpot then the residue is taxed twice, three times, etc. Returns are about 76%, 69%, 62%, etc, so superfectas are to be attempted just once a year by the average punter-this corresponds to the number of times sheep are shorn! Recently, I have made efforts to provide comprehensive computer-based calculations using the 'points start' in the weekly Pick The Winners footy game. The team given the 'points start' is obviously the favoured team, the other side being the 'underdog. The conversion of 'points start' to odds n-takes for interesting reading.

Points start is determined by a panel of experts early in the week. Overall, their estimates have shown remarkable consistency-from 573 games a total of 291 (50.8 per cent) were won by the favoured team, the underdog winning 282 times, given the handicap, though it lost the actual game 59 times.

Pick The Winner punters would have been expected to return 80 cents in the dollar-in fact, 93 such games returned 78.5 cents in the dollar. This indicates that FootyTab punters have a very small edge on the experts in determining the outcome of games when assessing handicaps.

It's well known that tote punters compare divvies on offer with those displayed by bookmakers; similarly, the 'points start' offers a scale of odds which may be utilised in playing the other two games-Pick The Margin and Pick The Score. Additionally, they also indicate the odds on the actual outcome of a game should bookmakers ever be allowed to bet in this medium (in N.S.W.).

The tables give the odds based on ‘points start' and are calculated to give a 100 per cent return to the punter. Allowance, therefore, has to be made for the statutory deductions from FootyTab pools, and any profit margins by those who bet straightout on the result of a game.

By Hans Eisler

By Hans EislerPRACTICAL PUNTING - SEPTEMBER 1991