In Part 1 of this series where I commenced a review on staking plans, which I termed the Practical Punting Monthly Staking Plan Challenge, I presented two staking methods that did not quite meet the guidelines we were looking for.

Based on the principles outlined in one of the classic tomes on money management, as outlined in the book Dr. Z’s Beat The Racetrack by William Ziemba and Donald Hausch, those guidelines are:

- Current betting wealth (betting bank) should influence bet size – that is, as the bankroll increases so should, on average, bet size;

- The likelihood of winning should influence bet size;

- The “edge” – that is the measure of the difference between the estimate of the likelihood of winning and the public’s estimate translated into return per dollar bet, should also influence bet size; and

- The trade-off between betting bank growth and its security needs to be considered.

As with the two staking plans reviewed previously, the ones in this month’s article have been tested against the actual selections of one of Australia’s finest form analysts, Stuart Mackay, a resident of Melbourne who specialises in Perth racing and who uses the nom de plume of the King Of Belmont.

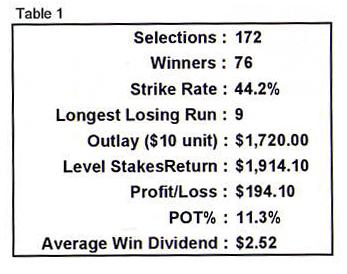

Although making selections for every Perth race, Saturdays as well as the mid weeks, Stuart also nominates his best bet for each Perth meeting, and it is these that have been used to test out the various staking plans. Table 1 is an update of last month’s statistics on Stuart’s “best bets” performance from January 1 2003 up to November 24 2004.

In fact, during the month between the two articles, Stuart has made eight additional selections for four winners, increasing his strike rate from 43.9 per cent to 44.2 per cent, which has resulted in a slight increase in profits of 0.4 of a unit but a drop in Profit On Turnover (POT) from 11.6 per cent to 11.3 per cent.

Right or wrong, when measuring performance it has been a tradition that “level stakes” is the stick or rod by which all else is judged. However, even a level stakes approach requires an initial decision on the bet size, be it 5 per cent, 2.5 per cent, 1 per cent or whatever of the starting bank.

Author of the acclaimed Commonsense Betting, Dick Mitchell, rightfully states that “The proper flat-bet amount is the percentage of your bankroll equal to your single race edge divided by your average odds”.

The “edge” is defined as the odds multiplied by the probability of winning minus the probability of losing, expressed as: E = O x P(W) – P(L), where E = Edge; O = Odds; P(W) = Probability of winning; and P(L) = Probability of losing.

Where the odds available are $3 (2/1) and the assessed chances of winning are 40 per cent, the punter’s edge would be: E = 2 x 0.4 – 0.6 = 0.2 or 20 per cent.

The long-term “edge” with Stuart Mackay’s best bets are: E = 1.52 x 0.442 – 0.558 = 0.113 or 11.3 per cent, which of course coincides with his level stakes POT.

The first of the staking plans put under the hammer this month is an adaptation taken from The Equestrian E-Book of Staking Plans and is described as the personal favourite of my colleague, The Optimist.

The rules for the Level Logical Progression are to bet a specific percentage of the highest point that the betting bank reaches, never going back, e.g. betting 2.5 per cent of $1,000 would result in initial bet size of $25.

When the betting bank doubles, a brake of 50 per cent is applied whereby half the profits are withdrawn, and betting then continues on the revised level, e.g. when a $1,000 bank doubles to $2,000, an amount of $500 would be taken out to spend (whatever) leaving $1,500 and a revised stake of $37.50 (2.5 per cent of $1,500).

So long as the good times roll and the profits keep mounting, this approach can go on ad infinitum until such time as the “comfort zone” of a maximum bet size is reached.

When applied to Stuart Mackay’s selections, this staking plan did the job inasmuch as capitalising on his level stakes profit, albeit with a slightly lower POT.

Commencing with a $1,000 bank the maximum bet reached of $48 was less than double the initial bet of $25, returning a profit of $563 to date – a very, very safe approach indeed.

However, by an adaptation of an additional rule in regard to the handling of losing runs, all the good aspects of this plan can be retained with an increased level of safety.

This simple rule states that each time a run of outs of four comes along, a line is ruled with betting re-commencing at the starting point of 2.5 per cent of the initial bank.

Not only does this result in an increased profit, it also improves the POT to one which betters level stakes – and as already mentioned that is the traditional measuring stick.

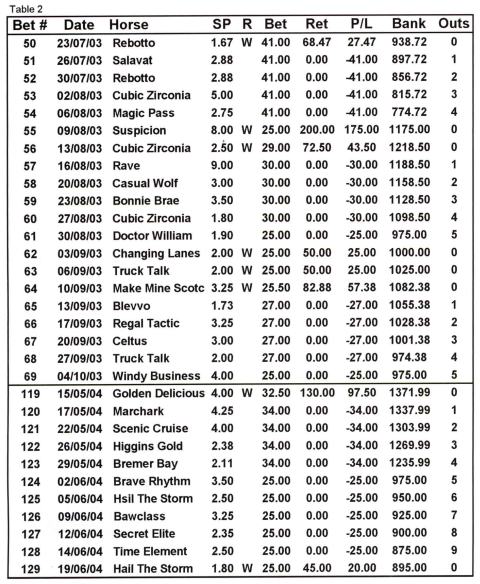

Table 2 demonstrates how the losing run break comes into effect and as it turned out it was a costly one at bet #55, when after four losers in a row, the highest winner of the complete sequence of bets had only a minimum size stake – they’re the breaks that can sometimes work against you.

Overall, the revised Level Logical Progression staking plan performed quite well with a POT of 12.5 per cent, a maximum bet reached of $45.50, again less than double the initial bet of $25 and returning a profit of $600.

Either version should do the job on any set of selections that returns a level stake profit, maximising profit in a safe and secure manner, although there may be a slight drop in POT in some instances.

Finally, one of my own favourites is put to the test, a variation of the well known long standing target staking, which I have named the Small Target Plan.

So named because the target is a mere 10 cents (or a multiple thereof) per race, with safety a paramount consideration.

The divisor is of critical importance as to how the plan will perform and while an aggressive approach (lower divisor) would enhance profits on any successful set of selections, a more conservative aim (higher divisor) is recommended. For the purposes of this test, a divisor of five has been used.

The target is always 10 cents a race (or a multiple thereof), e.g. after 100 races the target would be $10.

The objective for determining the actual bet size is the difference between the target and the accumulated profit or loss. After 20 bets an accumulated loss of $5 would be added to the target of $2 (10 cents per race), making an objective of $7, which is then divided by five, giving a result of $1.40, which is then rounded down to give an actual bet size of $1. It is important that all bets are rounded down to the nearest 50c multiple – never round upwards.

When the accumulated profit exceeds the objective, then the bet size is always equal to the base bet.

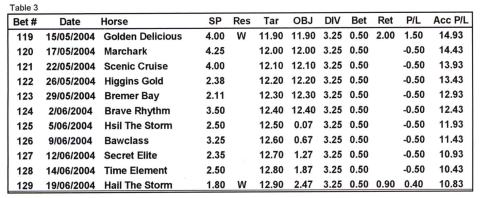

Table 3 displays how the longest losing run of nine was handled using the Small Target Plan. The accumulated profits absorbed the losses incurred with the result that the bet size stayed at the base level during this period.

Table 4 displays the performance based on the recommended divisor of five, while Table 5 displays the performance with the far more aggressive divisor of 3.25, which I consider to be the optimum for these selections and although looking impressive, is certainly not for the faint hearted.

In saying that though, over 90 per cent of the bets made were at level stakes, yet close to 5 per cent was added to the bottom line and with a maximum bet of $40 (based on a $10 base bet) compares well with other staking plans which take an aggressive approach.

The two staking plans presented in this article might not have strictly met all four of William Ziemba and Donald Hausch’s guidelines, but I think they certainly gave their wealth tree a good shake and both carry the recommended tag.

Click here to read Part 1.

By EJ Minnis

PRACTICAL PUNTING - JANUARY 2005